When people search for why does whales explode, they might be curious about a strange phenomenon in the cryptocurrency world. In this context, “whales” doesn’t refer to the massive sea creatures but to powerful players in the crypto market individuals or entities holding vast amounts of digital assets. So, why do these crypto whales “explode,” and what does it mean for the market? Let’s dive into the details.

Contents

What Are Crypto Whales?

Crypto whales are investors or organizations with significant holdings of a cryptocurrency, such as Bitcoin (BTC), Ethereum (ETH), or altcoins. These players often own thousands of coins enough to influence market prices with a single move. For example, a Bitcoin whale might hold 1,000 BTC or more, while an Ethereum whale could control 5,000 ETH or a substantial percentage of a smaller token’s supply.

The term “whale” comes from traditional finance, symbolizing their ability to create waves in the market, much like a whale’s splash in the ocean. Famous examples include early Bitcoin adopters like Satoshi Nakamoto (rumored to hold 1 million BTC) or companies like MicroStrategy, which owns over 150,000 BTC as of 2025.

Why Does Whales Explode in Crypto?

The phrase “whales explode” isn’t literal but metaphorical. It describes the dramatic impact whales have when they make large transactions or strategic moves. Here’s why this happens:

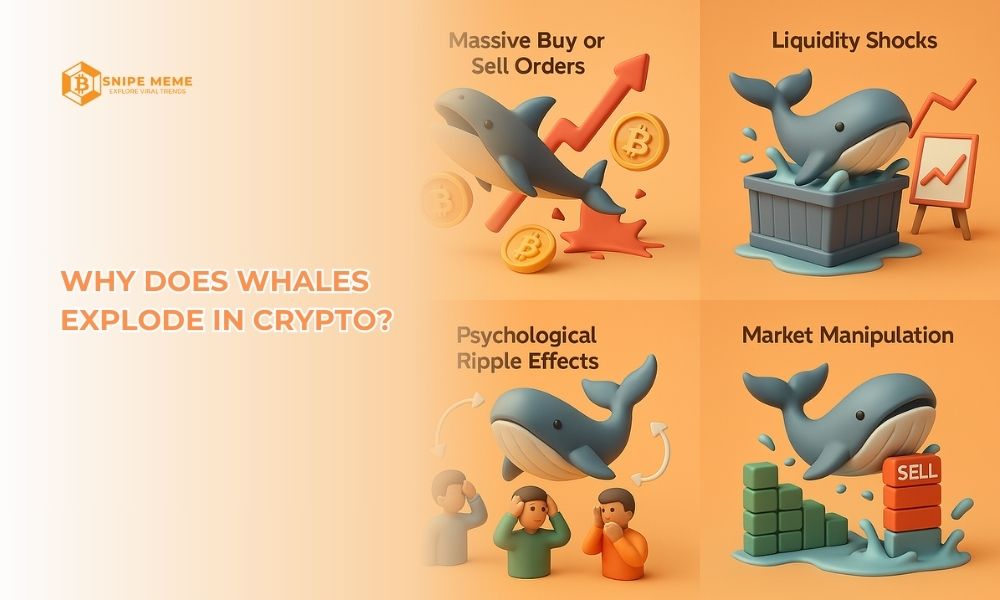

Massive Buy or Sell Orders

Whales can jolt markets with huge transactions, sending prices soaring or crashing in an instant. Picture a whale dumping 10,000 BTC on an exchange—supply spikes, prices plummet, and panic selling erupts among smaller traders. This sudden shift explains why does whales explode as a common question when markets turn wild.

Such moves aren’t always dumps; a massive buy can ignite a rally just as fast. When a whale scoops up coins, FOMO kicks in, driving prices skyward as others pile in. These explosive swings highlight the raw power whales wield over crypto’s fragile balance.

Liquidity Shocks

Whales thrive in markets with thin liquidity, where their trades hit like thunderbolts. A single high-volume move in a small altcoin can overwhelm order books, causing drastic price jumps or drops. The crypto community tracks these shifts via Whale Alert or blockchain tools, watching for the next big splash.

These transactions don’t just ripple—they amplify. A whale’s bold play can signal confidence or doubt, spurring herd behavior that magnifies the chaos. This chain reaction turns one trade into a market-defining moment, leaving traders scrambling to adapt to the sudden upheaval.

Psychological Ripple Effects

Whale moves carry weight beyond numbers—they mess with minds. Tools like Whale Alert flag their trades, sparking speculation across the community. A sudden “explosion” from a whale can scream optimism or panic, pushing others to mimic the move and fuel wild trends.

This psychological domino effect is relentless. When a whale’s high-profile transaction hits, it’s not just price that shifts—confidence does too. Smaller investors, caught in the wake, amplify the impact, turning a single action into a tidal wave that reshapes the market’s mood and direction.

Market Manipulation

Some whales orchestrate chaos for profit, asking why does whales explode as they pull the strings. Using “sell walls,” they flood exchanges to depress prices, then buy cheap. Or they stack “buy walls” to pump values, cashing out at the peak while others chase the hype.

These calculated plays exploit the less savvy. Smaller traders, reacting to the manipulated trends, often lose out as whales rake in gains. This strategic disruption creates a volatile battlefield where the unprepared get swept away by the whale’s cunning tidal shifts.

Real-World Examples of Whales “Exploding”

Tesla’s Bitcoin Purchase (2021)

In 2021, Tesla dropped $1.5 billion into Bitcoin, spiking its price 17% almost overnight. This whale move ignited a market explosion, unleashing bullish frenzy. Traders scrambled to buy, gripped by FOMO, as Elon Musk’s tweets fueled the fire. It’s a prime example of why does whales explode, showing how one big player can flip crypto sentiment in a flash.

Shiba Inu Surge (2021)

In 2021, Ethereum whales snapped up billions of SHIB tokens, sparking a wild market surge. This explosive push rocketed Shiba Inu’s market cap past $20 billion in mere weeks. From a near-worthless price, it soared over 1,000%, driven by FOMO and social media hype. It proved whales can transform a meme coin into a juggernaut almost instantly.

Terra Collapse (2022)

In 2022, seven whales unloaded huge UST holdings, shattering Terra’s fragile ecosystem. This devastating move blew apart the stablecoin’s $1 peg, triggering a bank run that tanked UST and LUNA. The $40 billion wipeout shook faith in algorithmic stablecoins. It’s a stark answer to why does whales explode, revealing their power to unravel markets in a heartbeat.

How to Track Crypto Whales

Want to know when whales are about to “explode” the market? Here’s how you can stay ahead:

Blockchain Explorers: Want to predict when whales might explode the market? Blockchain explorers like Etherscan and BitInfoCharts are your go-to tools. They let you monitor large wallet transactions in real-time, revealing whale moves. By tracking these shifts, you can spot potential price swings before they hit the broader crypto scene.

Whale Alert: Whale Alert helps you stay ahead of whales ready to explode the market. This platform sends real-time notifications for significant crypto movements across blockchains like Bitcoin and Ethereum. With instant updates on big trades, you can react quickly to whale activity and adjust your strategy accordingly.

Analytics Platforms: Services like Nansen and Arkham Intelligence track “smart money” wallets—whales with profitable trade histories. These platforms reveal patterns that might explode into market shifts. By analyzing their moves, you gain insights into potential pumps or dumps, keeping you one step ahead in the volatile crypto world.

Why Should You Care About Whales Exploding?

For traders, grasping why whales explode the market is vital. Their massive trades can spark opportunities, like buying low during a sell-off dip. Conversely, they pose risks—think pump-and-dump schemes that trap the unwary. Staying alert to whale moves helps you navigate these turbulent waters with confidence.

Whales don’t just destabilize; they add liquidity and shape trends. Savvy investors can ride these waves, capitalizing on price swings driven by whale actions. By understanding their motives, you can spot signals early, turning potential chaos into profit. In crypto, tracking whales is key to staying ahead.

In the crypto realm, whales don’t physically explode, but their huge trades and influence ripple powerfully across the market. From abrupt price swings to liquidity shifts or strategic manipulations, these “explosions” define the crypto terrain. By monitoring whale behavior and decoding their intentions, you can tackle this unpredictable sea with assurance. Want to stay ahead? Follow Snipe Meme for real-time insights and tips to ride the waves of whale activity like a pro!